Today Market Analysis: A Volatile Yet Promising Trading Day

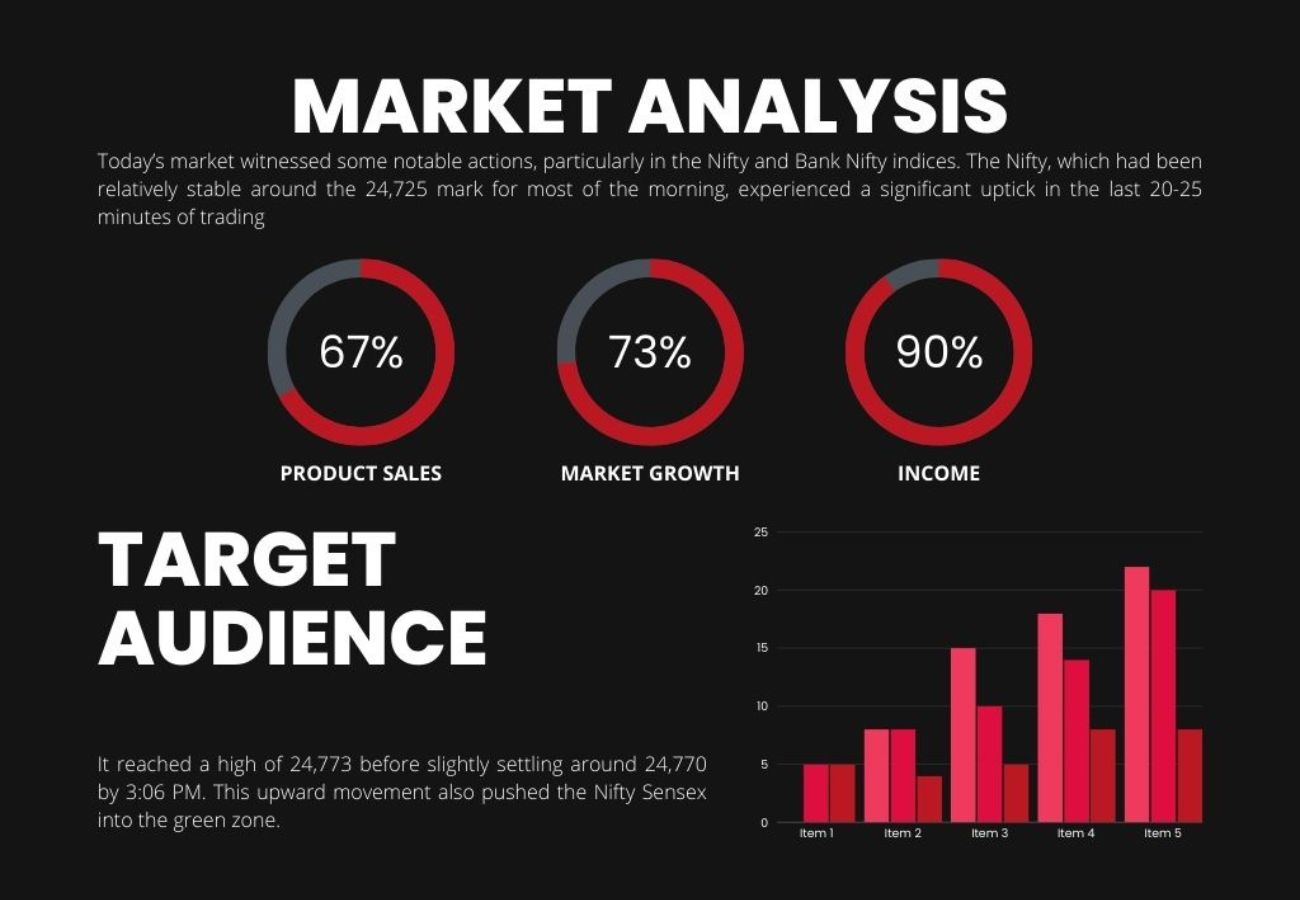

| Today’s market witnessed some notable actions, particularly in the Nifty and Bank Nifty indices. The Nifty, which had been relatively stable around the 24,725 mark for most of the morning, experienced a significant uptick in the last 20-25 minutes of trading. It reached a high of 24,773 before slightly settling around 24,770 by 3:06 PM. This upward movement also pushed the Nifty Sensex into the green zone.

The Bank Nifty, which is set for its weekly expiry today, showed a remarkable recovery, climbing nearly 400 points from its earlier lows. This recovery was largely fueled by the upward momentum in Nifty, as rising stocks in Nifty pulled up the Bank Nifty as well. Despite this breakout, caution remains, and I’m hesitant to make any buying recommendations at this moment. Given that this analysis comes post-market, any buying suggestion would be futile. Looking ahead, there is potential for Nifty to reach 24,800, 24,850, or even 24,900. However, given tomorrow’s Nifty expiry, I’m cautious about these moves, which may be more related to expiry-driven volatility. While the overall market displayed mixed sentiment with both bullish and bearish trends, small caps outperformed, and stock-specific actions were evident since morning. On the NSE, more than twice as many stocks were positive compared to those in the red, indicating a divided market with a slight bullish tilt. However, the market’s sluggishness, despite some sector-specific rallies, means it hasn’t been as lucrative for traders. |

Sector and Stock Highlights |

| Among sectors, the FMCG index outperformed today, with significant gains in Britannia, Hindustan Unilever, and ITC, each seeing a rise of about 1.25%. The media sector also showed strength, with stocks like DisTV, Hathaway, Nazara Tech, and Network 18 performing well. The Pharma sector also witnessed a rally, with DVS Laboratories making a strong move towards the 5000 mark on the back of some significant news, which I will share post-market.

In contrast, the Real Estate sector struggled, with the index down by around 1.25%. Stocks like Lodha, Godrej Properties, and Brigade saw declines, though Santek Realty bucked the trend with a 5.25% rise. ICICI Securities caught attention as it faced a decline. Preliminary reports suggest concerns over a potential delisting, which has caused unease among investors, especially given the company’s past dealings. However, further details are awaited to fully understand the situation. On the upside, stocks like Alok Industries, PNB Housing, Adani Wilmar, Nykaa, and Deepak Fertilizers saw significant gains, with turnover leaders including Mazgaon Dock, which surged 10% and stood at ₹533. Angel One also showed resilience, recording a turnover of 1822 crores. |

Conclusion

As we approach the closing of today’s session, Nifty is trading above the 24,750 mark. If it closes above this level, it could strengthen the bullish sentiment moving forward, despite the looming expiry tomorrow. I remain cautious about any expiry-related volatility but see no immediate negative signals. I will provide more stock-specific insights in my next article, so stay tuned for further updates.

Thank you for reading this analysis.

What is Driving Borosil, Supraja, and Ola Electric Today |

1 thought on “Today Market Analysis: A Volatile Yet Promising Trading Day”